Top 5 Digital Trends Transforming The Insurance Industry

- Mobile

- August 14, 2020

Digitalization has not only transformed the lives of individuals, but it has also changed the face of every industry. According to a 2018 survey, over 70 percent of companies have digital transformation strategies in place to ensure efficiency in their business.

One industry that continues to be transformed by digitalization is the insurance sector. The insurance industry forms an integral part of the economies of various countries.

For example, according to the latest research, insuranceand related activities contributed nearly $630 billion, or 2.9 percent, to the GDP in 2019.

From the consumer’s standpoint, the effect of digitalization on the industry might appear minimal. However, the fact remains that from the operations side, digital technologies have changed the way things were done, and operations were carried out.

Not only has the digitalization made the insurance industry more efficient, but it has also streamlined the functions.

Top Digital Trends Shaping the Insurance Industry

This blog covers the top digital trends that are currently transforming the insurance industry:

Predictive Analytics

Predictive analytics is used to predicthuman behavior and future events through a combination of statistical techniques.

It uses a combination of algorithms and machine learning to determine the future based on past data and current trends. The precision of these assessments has resulted in the widespread adoption of predictive analytics by the organizations.

According to a report by GlobeNewswire, the global predictive analytics market is expected to reach approximately USD 10.95 billion by 2022.

The insurance industry has benefitted massively from its application. With the help of predictive analytics, insurers can now collect data and analyze it to predict customer behavior.

In the world of insurance, predicting consumer behavior can make all the difference in the amount of profit or loss accrued by the company.

For instance, let’s say an insurance company can predict how risk-prone a given customer is, they will then charge interest accordingly.

Similarly, property insurance companies use predictive analytics to collect data from agent interactions, telematics, smart homes, and customer interactions to best manage relationships with their customers.

Here are some ways predictive analytics can help streamline operations within the insurance sector:

- Selection of pricing

- Risk identification

- Detecting outlier claims

- Identifying the risk of cancellation

To sum it up, the rise of predictive analytics has allowed insurance companies to do a better risk assessment, maximize returns, and improvethe overall efficiency.

Internet of Things (IoT)

IoT is set to become the next revolutionary thingin the realm of digital technology. According to Gartner, by the end of 2020, there will be over 5.8 billion automotive and enterprise IoT endpoints.

Insurance companies are also leading various initiatives,and IoT is at the core of it all.For instance, health insurers can now access real-time data about their customers’ health with the help of IoT.

It helps in two ways. Firstly, it allows insurers to set customized prices for their policies. Secondly, it allows them to use the data to impact the lives of their customers positively.

Vitality is an excellent example of the integration of IoT in the insurance industry. Their wellness product is linked with insurance tools and offers customers rewards if they achieve goals, like walking a given number of steps, etc.

The auto insurance sector has also benefited from the use of IoT. For example, Progressive Corporation, one of the largest car insurance companies in the United States, has employed usage-based insurance telematics to monitor the performance of the drivers constantly.

By doing so, theycan offer better prices and returns on their policies, as well as reward safe drivers to deliver optimum customer experience.

Artificial Intelligence (AI)

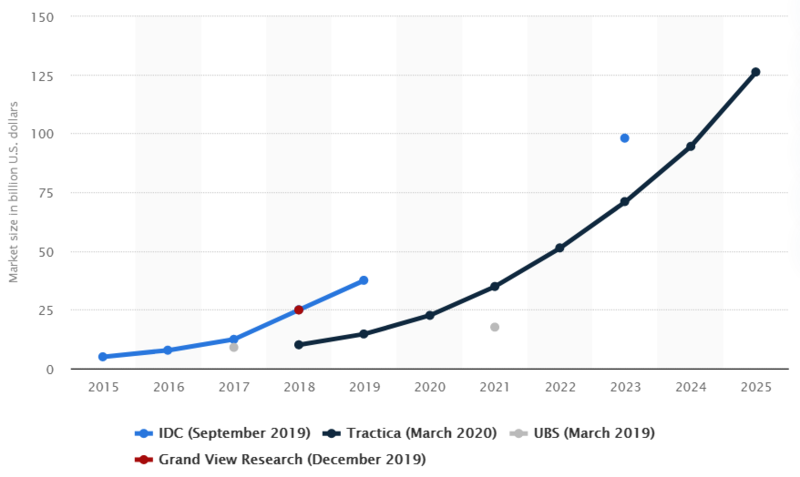

Artificial Intelligence is another digital trend that is transforming one sector after the other. According to Statista, the AI market size is expected to reach 125 billion USD by 2025.

In a world where consumers wish for personalization and companies want efficiency, AI serves as the perfect solution. It reduces the burden on human resources and also offers a more personalized experience to customers.

AI helps insurers to boosttheir claims turnaround cycles as well as revampthe underwriting process. By churning data faster, the process of reporting becomes quicker and accurate since human error is removed from the equation.

Various insurance companies have begun using AI, in some way or another. Geico, an established insurance firm, makes use of AI-powered chatbots for settling claims.

PwC, in its reporttitled ‘AI in Insurance: Hype or reality?’forecasted that the use of AI in the insurance sector would automate customer-facing underwriting while also improving the efficiency.

As technology progresses over time, it will help identify new sources of revenue as well as to detect risk.

Online Purchases

As per Statista, e-commerce sales are likely to reach a whopping 4.2 trillion USD by 2021. Oberlo reports that there are over 2 billion online shoppers. These stats showcase the shift of masses from traditional purchases to online shopping.

The insurance sector has also benefitted from this change in consumer preference. In a world where most purchases begin with online searches, insurance companies are also changing their strategies to incorporate online shopping.

Today, almost allinsurance firms offer free online quotes. Additionally, people can buy insurance products like business and surety bonds online.

Insurance companies are striving to make the online process to buy policies simpler and more convenient. They also offer lower premiums if the insurance is purchased online.

Machine Learning

While machine learning comes under the ambit of AI, the trend deserves to be mentioned separately due to its sheer depth.

Machine learning revolves around the idea that machines can be built to process and learn data on their own without the supervision of humans. Just like predictive analysis and AI, machine learning helps the insurance industry to increase efficiency.

Here, files are made accessible via the cloud. The analysis is done using pre-programmed algorithms, and further decisions are taken automatically as well.

For instance, Allstate partnered with Earley Information Science to design a virtual assistant named Able. The assistant helps Allstate agents in gathering information about their business products.

On-Demand Insurance

When you think of on-demand products, generally, offerings like streaming services come to your mind.

The popularity of on-demand services has been continually rising. Since these services are faster and convenient, people prefer them over other types of service. This trend can be seen across sectors, regardless of whether they are B2B or B2C.

Insurance-on-demand is a relatively new concept. However, various startups have sprungupoffering such services. For instance, Dinghy is an insurance service that allows freelancers and contractors to purchase insurance policies when they need it, with the help of an app.

On-demand insurance is sought after due to its simplicity, relevancy, and personalization. While this trend is relatively new and considerably unexplored, it surely has the potential to become an essential part of the sector.

How does MindInventory help?

Digital trends are changing how the insurance industry functions. If you operate within the insurance sector, you must takedigitalization into account and try to incorporate it into the functions of your company.

The benefits of digitalization for the industry are there to be seen. For instance, predictive analysis and machine learning have provided insurance companies with a trove of data. Based on this data, they can precisely predict future trends and events.

The data collected from these solutions can also be fed into IoT to further perfect the offering and pricing. Finally, an on-demand app that features an online purchasing option can help in targeting more buyers.

If you are an insurance industry professional seeking ways to make your business more efficient with the integration of digitalization, then Mindinventory can help you out.

Whether it be emerging solutions like the IoT, web development, or cross-platform app development, our team is here to help you implement these solutions and improve the efficiency of your company.

Verdict

The insurance sector is among the many thriving industries in the world. It is predicted that the sector will show positive growth in the years to come.

The success of this insurance industry, however, depends massively on the implementation of digital trends and making the entire process convenient for the users.