Rebuilding Corporate Health Insurance Infrastructure with AI-First, Cloud-Native Solutions

The Challenge

Overcoming the Complexities of Corporate Health Insurance

Corporate health insurance has long been plagued by fragmented systems, slow claims processing, and a lack of transparency for both employees and employers. Employees often found it difficult to navigate complex healthcare benefits, leading to poor decision-making when it came to utilizing their available resources. For employers, managing the entire health insurance lifecycle—especially claims, wellness programs, and cost containment—was an inefficient, manual process that failed to scale as the organization grew. Moreover, with rising healthcare costs, fluctuating regulations, and increasing demand for personalized employee healthcare, traditional systems were not equipped to handle the complexity. Our client, a seed-funded healthcare startup, sought to revolutionize this space by building a cloud-native, AI-driven platform designed to simplify care navigation, automate claims processing, and provide actionable data insights—all while ensuring full regulatory compliance and data security.

The Solution

A Seamless, Scalable Platform for Corporate Health Insurance

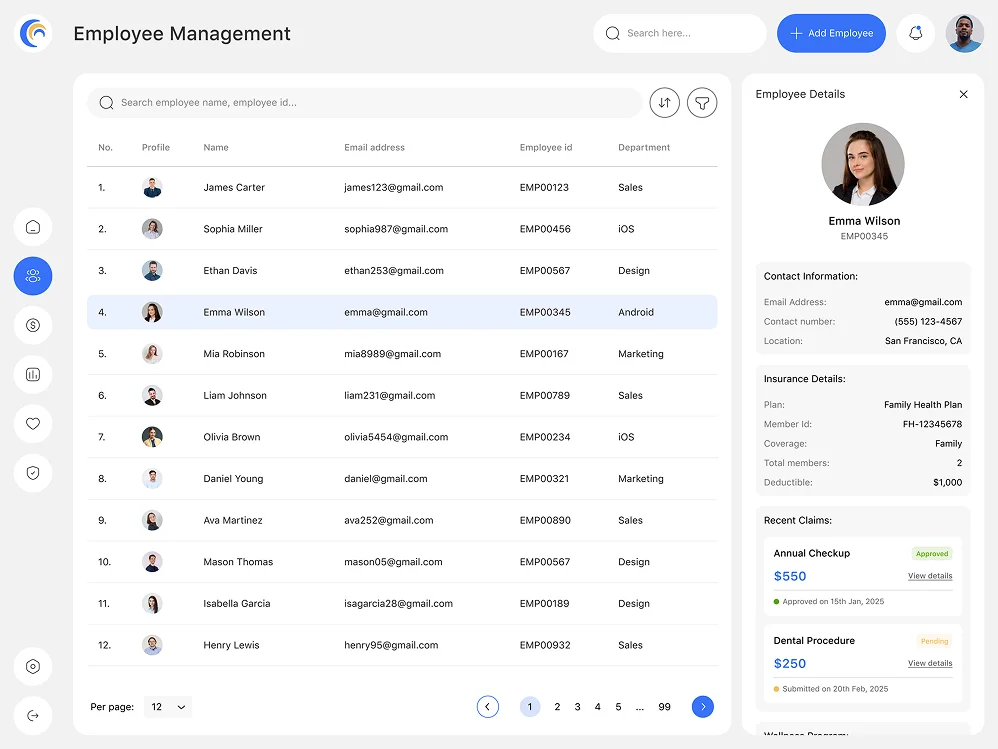

Personalized Care Navigation & Employee Support

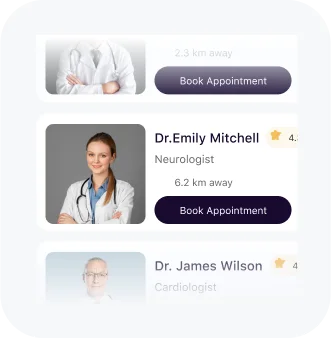

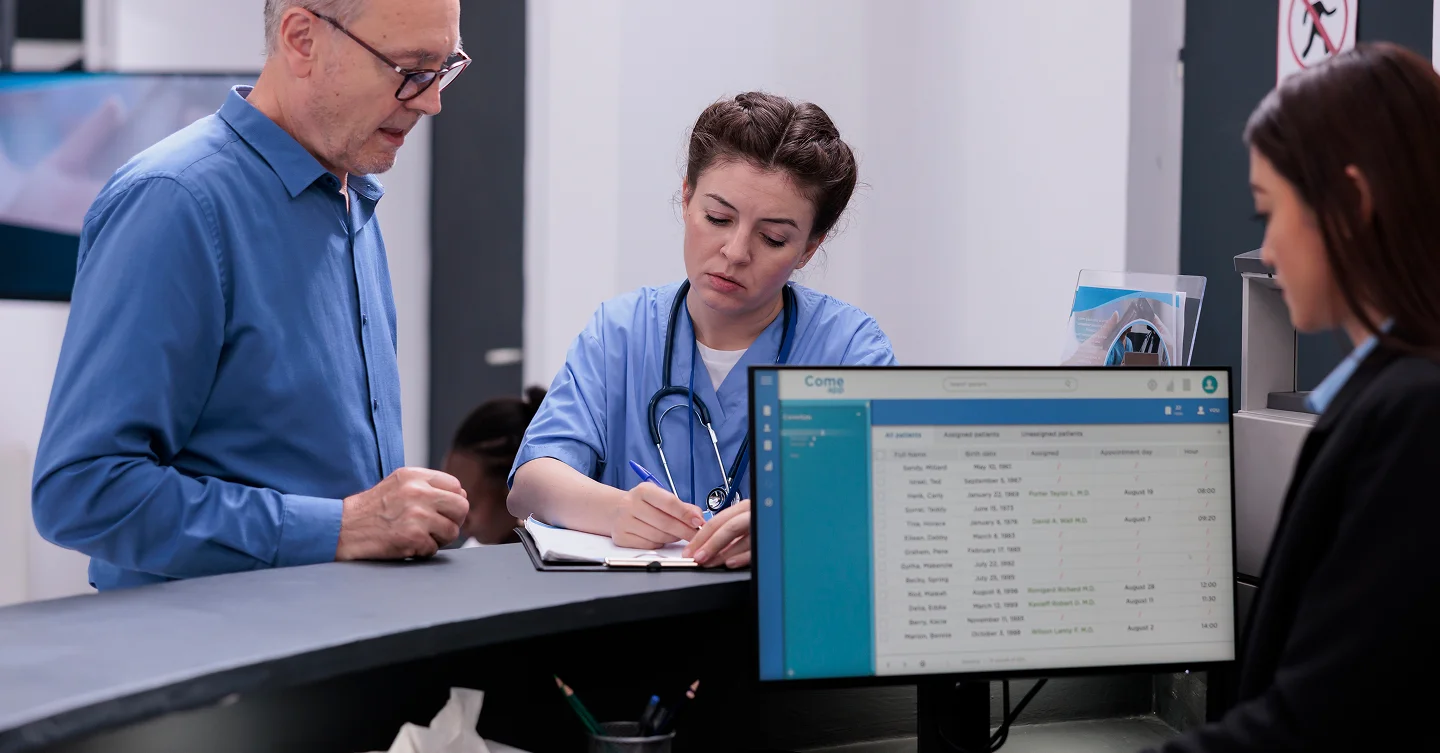

The first challenge we addressed was the fragmentation in care navigation. Employees often had trouble understanding and accessing their benefits, leading to underutilization and confusion. To solve this, we implemented an AI-powered care navigation system that guides employees through every step of their healthcare journey, from finding the right providers to understanding wellness programs and prescription benefits.

Using AWS Lambda and Google Cloud’s AI tools, we built the intelligent algorithms that enable personalized care recommendations based on an employee's medical history, preferences, and even real-time health data. This tailored approach helps employees make more informed decisions about their healthcare, improving both outcomes and satisfaction.

We also integrated Natural Language Processing (NLP) technology to allow employees to interact with the system via conversational interfaces (chatbots), further enhancing the user experience and making it easier for employees to ask questions and get guidance instantly.

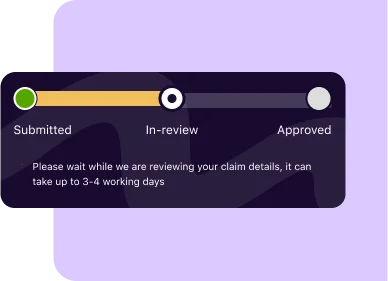

Streamlined Claims Processing with Real-Time Updates

Another major hurdle was the slow and error-prone claims processing that led to delays and frustration for employees. We recognized that in today’s fast-paced world, waiting weeks for claim resolution is unacceptable.

To address this, we implemented an automated claims processing workflow using Robotic Process Automation (RPA), powered by UiPath and integrated into the platform. These automated bots now handle the bulk of the claims validation, reducing errors and speeding up the entire claims process. Claims that would normally take several weeks are now processed within days, providing employees with quick resolution and greater transparency.

Through continuous monitoring and fine-tuning, the platform can also flag potential issues, such as eligibility discrepancies or fraud, before they cause delays or unnecessary complications.

Scalable, Cloud-Native Infrastructure to Support Growth

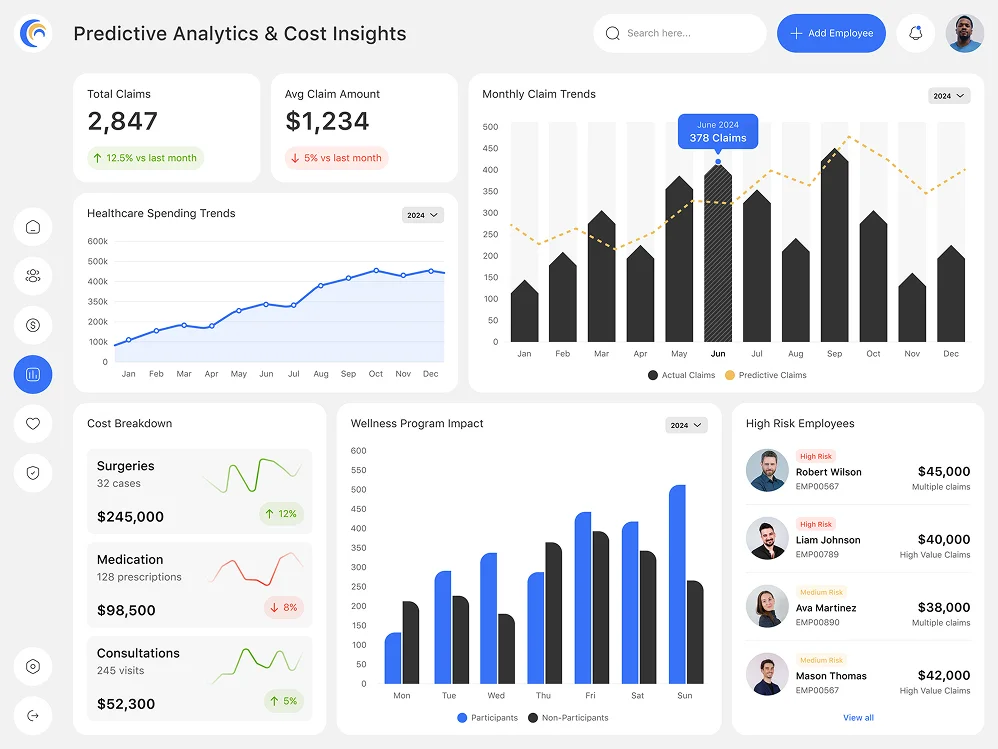

Rising healthcare costs have always been a challenge for employers trying to provide comprehensive health insurance to their employees. With traditional systems, employers had little insight into how their healthcare dollars were being spent, making it difficult to optimize wellness programs or identify high-risk areas that could drive up costs.

To address this, we integrated predictive analytics into the platform, powered by TensorFlow and Python-based algorithms, which provided employers with real-time insights into healthcare trends, potential high-cost claims, and areas where wellness programs could have the most impact. By analyzing both historical and real-time health data, the platform can predict trends and flag potential risks early, giving employers the ability to intervene proactively.

Additionally, the platform’s data-driven approach allows employers to manage their overall healthcare costs more effectively by identifying the most cost-effective treatments and negotiating better insurance terms with providers.

Compliance and Security: Meeting Industry Standards

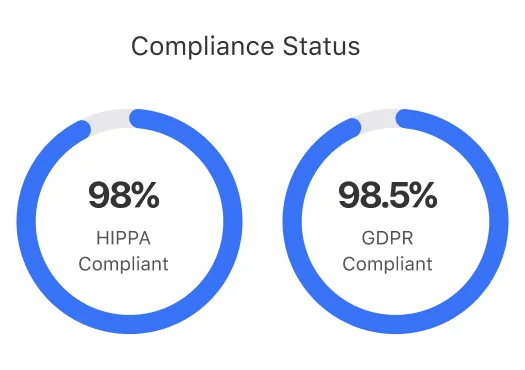

In the highly regulated healthcare space, compliance with standards such as HIPAA and GDPR is non-negotiable. The platform was designed with security and compliance at its core. Sensitive health data is encrypted both at rest and in transit, ensuring that all information remains secure and protected from unauthorized access.

We also integrated multi-factor authentication (MFA) and role-based access control (RBAC) systems using Auth0 to manage and secure access. Furthermore, the platform was designed to comply with both HIPAA and GDPR, ensuring full protection of patient information while also allowing for seamless data processing and analytics within those regulatory frameworks.

To ensure ongoing compliance, we deployed automated auditing tools and continuous security monitoring using Splunk and Datadog to detect any potential vulnerabilities or breaches, providing a continuous feedback loop for improving security.

The Team Behind The Project

This project required a diverse team of experts to ensure its success, from cloud engineers to AI specialists. Our team consisted of:

AI and Data Science Experts

Who developed the machine learning models for predictive analytics, claims adjudication, and personalized care recommendations using TensorFlow and Python.

Security & Compliance Specialists

Who worked closely with the healthcare team to ensure HIPAA and GDPR compliance throughout the platform, implementing AWS KMS for encryption and Auth0 for authentication.

Cloud Architects

Who built and deployed the microservices architecture using AWS and Kubernetes, ensuring scalability and high performance.

Software Developers

Who worked on the core platform features, such as the care navigation system, claims management, and user interface.

UX/UI Designers

Who crafted an intuitive interface for employees to easily navigate their healthcare benefits and interact with the platform.

Quality Assurance Engineers

Who conducted rigorous testing to ensure the platform met all functional, security, and compliance requirements before launch.

The Results

Transforming Corporate Health Insurance

The revamped platform has successfully transformed the corporate health insurance experience for both employers and employees. Some of the key results include:

Employees now have easy access to personalized care recommendations and real-time claims updates, leading to better engagement and higher satisfaction.

Predictive analytics give employers the tools they need to identify high-risk employees, optimize healthcare spending, and implement effective wellness programs.

The automated claims processing system has cut processing times by 70%, ensuring that employees receive faster reimbursements and fewer errors.

The platform’s cloud-native, microservices architecture has allowed the client to scale with ease as they add new users, expand features, and enter new markets.

The platform is fully compliant with HIPAA and GDPR standards, ensuring that sensitive health information is securely stored and protected.

Conclusion

A New Era for Corporate Health Insurance

This case study highlights how we successfully rebuilt the core infrastructure behind corporate health insurance, leveraging cloud-native technology, AI-powered solutions, and comprehensive security protocols to streamline operations and improve both the employee and employer experience. By offering real-time claims processing, personalized care navigation, and predictive insights, we have enabled our client to bring greater transparency, efficiency, and value to the corporate health insurance market.

Contact us today to learn how we can help you build a scalable, AI-driven platform for your corporate health insurance needs!