Empowering Webshops with Better Payment Management Through Automation

- Client: Advisoa ApS

- Industry: Fintech

- Project Type: Payment Management Solutions

-

Core Tech:

- Node.js

- Next.js

-

Services Provided:

- Web App Development

- Wireframing

- UI UX Design

- Strategic Consultation

A Fragmented Payment Landscape Draining Merchants

For thousands of webshops, payment processing felt like a black hole—one that drained money, time, and control. Merchants were caught in an ecosystem where:

Payments were scattered across multiple providers, forcing merchants to engage in time-consuming manual reconciliation and rely on outdated spreadsheets.

Hidden fees and rigid contracts meant that webshops often ended up paying more than necessary, without a clear understanding of the costs.

Without centralized oversight, small businesses were stuck with providers offering little to no room for negotiation or tailored solutions.

Core Issues Impacting Webshop Profitability

Webshops needed a way to take back control over their payment ecosystem—without the complexity, guesswork, and excessive costs.

This wasn’t just an inconvenience—it was a systemic issue costing businesses revenue and growth. In fact, 8 out of 10 webshops were trapped in inefficient, overpriced payment solutions.

After advising over 2,000 webshops on payment solution related challenges, the team at Advisoa recognized a critical gap:

- Scattered payments across multiple providers, making reconciliation through spreadsheets and manual calculations a nightmare.

- Small businesses lacked the leverage to demand better rates or tailor-made solutions.

- Hidden fees and complex contracts quietly ate into already thin margins.

- Merchants were stuck with inefficient providers, unable to compare or switch to better solutions.

Thus, the idea for the world’s first digital payment expert was born—a platform that optimizes payment processing, automates accounting in compliance with the Digital Accounting Act, and empowers businesses with real-time financial insights across all channels.

The Solution

We embarked on a collaborative journey with Advisoa ApS to transform the chaotic payment landscape by developing a Digital Payment Expert that brings control back to the merchant with transparency and automation.

Automated Payment Optimization

One of the biggest challenges webshops faced was being stuck in expensive payment contracts. The solution we developed identifies and negotiates better payment terms by comparing offerings from providers such as Clearhaus and Swedbank Pay.

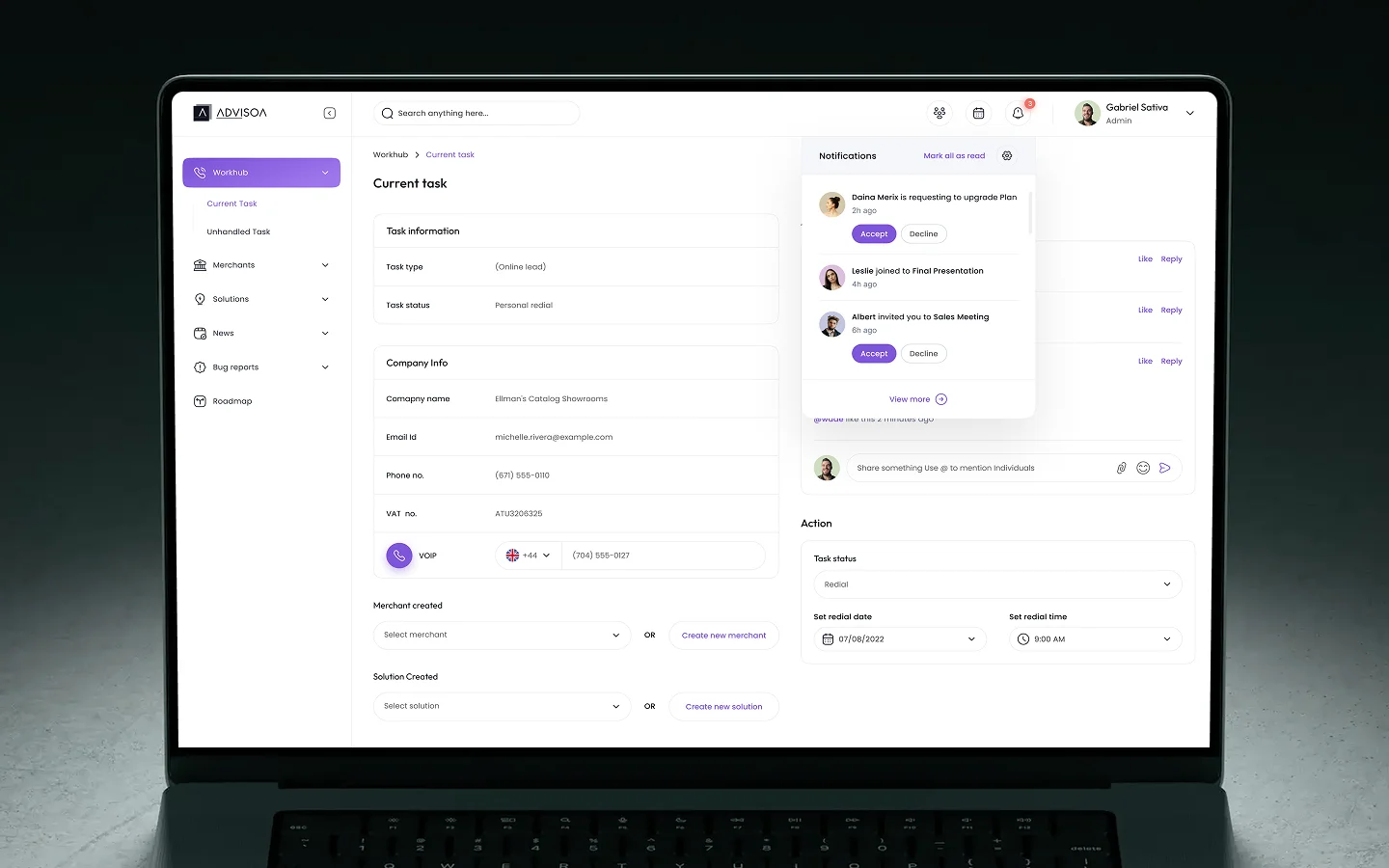

This automated negotiation enables merchants to switch providers or renegotiate fees without operational disruption, while still giving them the freedom to override when necessary—blending trust with control.

Eliminating Manual Labour with Autonomous Accounting

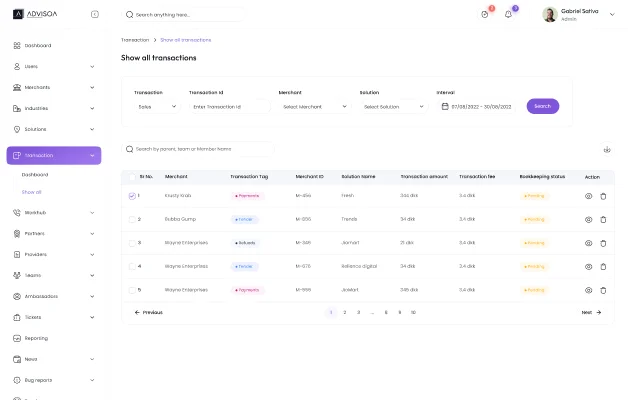

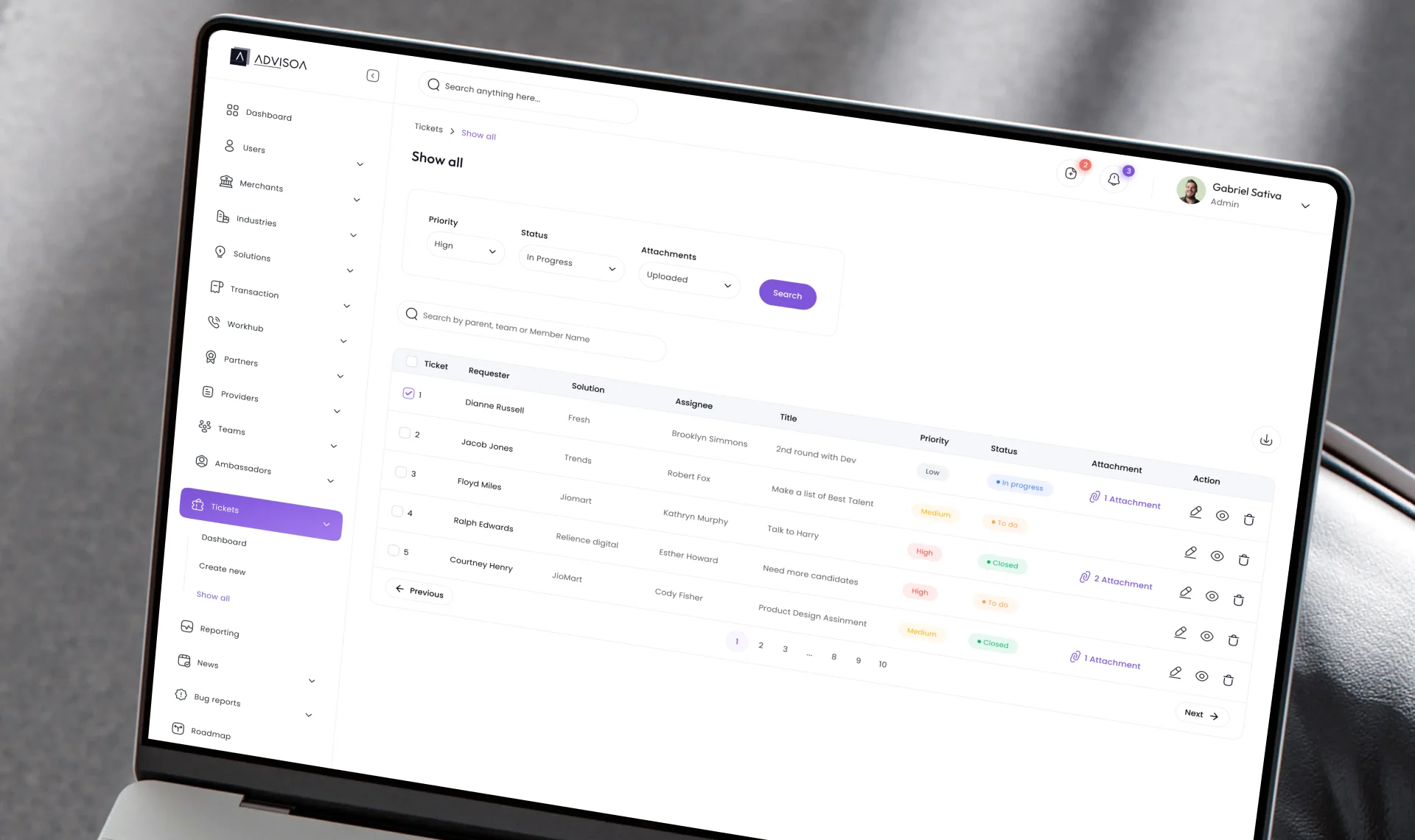

To help the merchants get out of the pile of receipts and spreadsheets, we designed a web app that allows merchants to directly record all relevant data—whether it be sales, payments, refunds, or transaction fees—from their online shop systems straight into accounting software like e-conomic or Dinero.

The bookkeeping automation ensures compliance with Denmark’s Digital Accounting Act, offering accurate, real-time financial reports for tax and financial planning, reducing manual labor, and boosting efficiency.

Ensured Security

Webshops face constant threats from cyberattacks, data breaches, and compliance failures that can jeopardize business operations. Recognizing these risks, our team implemented robust security measures to safeguard sensitive data and ensure compliance with industry standards. This includes AES-256 encryption for data protection, tokenization to minimize exposure to payment details, and strict access controls with multi-factor authentication.

Regular security assessments, secure third-party integrations, and more, further reinforce the platform’s defenses, ensuring adherence to PCI DSS and GDPR while mitigating potential risks.

Bringing the Entire WebShop Together

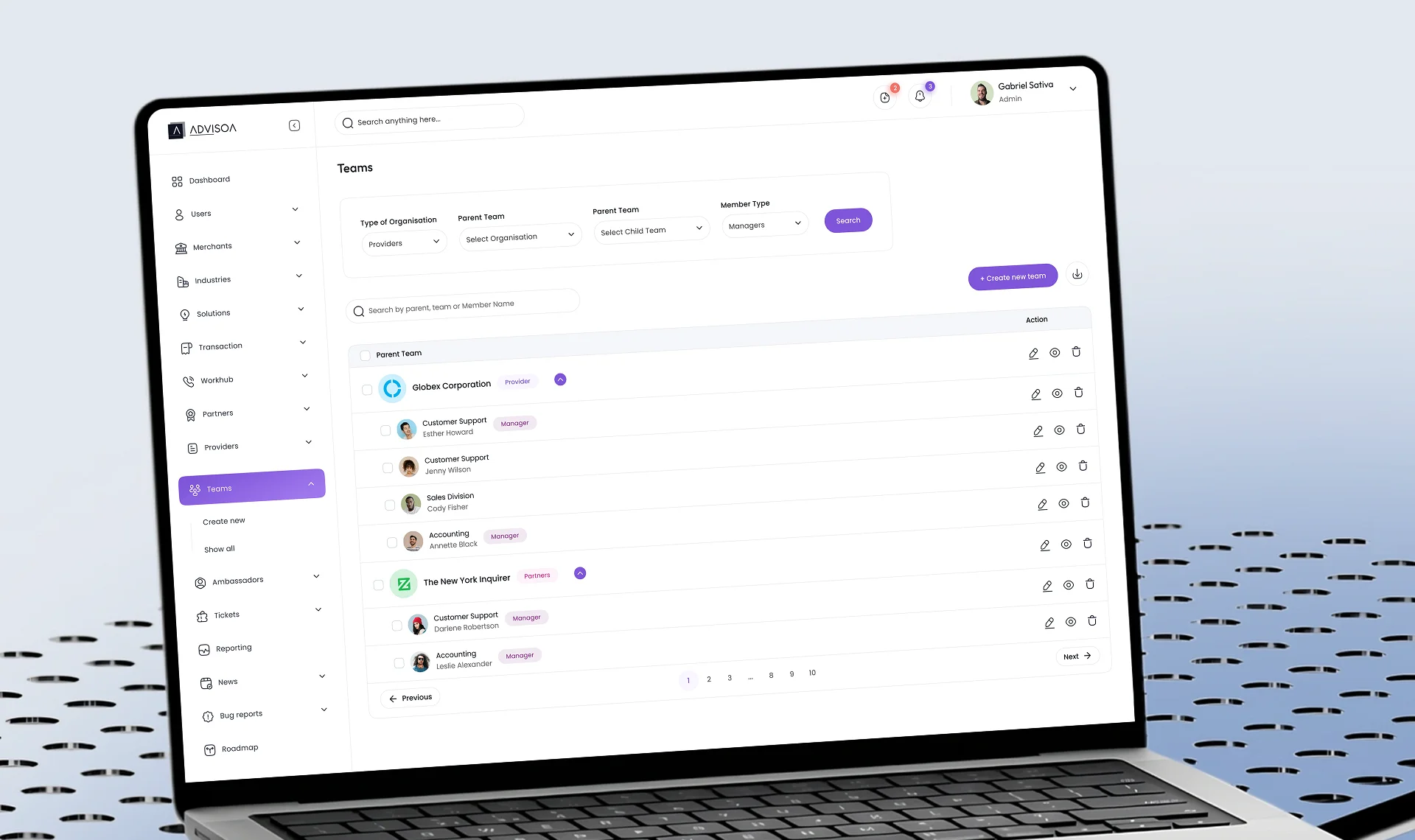

Integrating with diverse shop systems was a challenge due to their different APIs and data formats. Our team developed a flexible integration layer that can adapt to various API endpoints and data structures, ensuring compatibility with DanDomain, WooCommerce, and Shopify.

For payment providers, we created a standardized framework to handle different rate structures and negotiation processes, enabling us to compare and select the optimal provider for each client based on their transaction history and preferences.

Accounting tool integration required precise mapping of transaction data to ledger entries to ensure accurate bookkeeping, and we worked closely to understand their requirements of integration tools like e-conomic and Dinero.

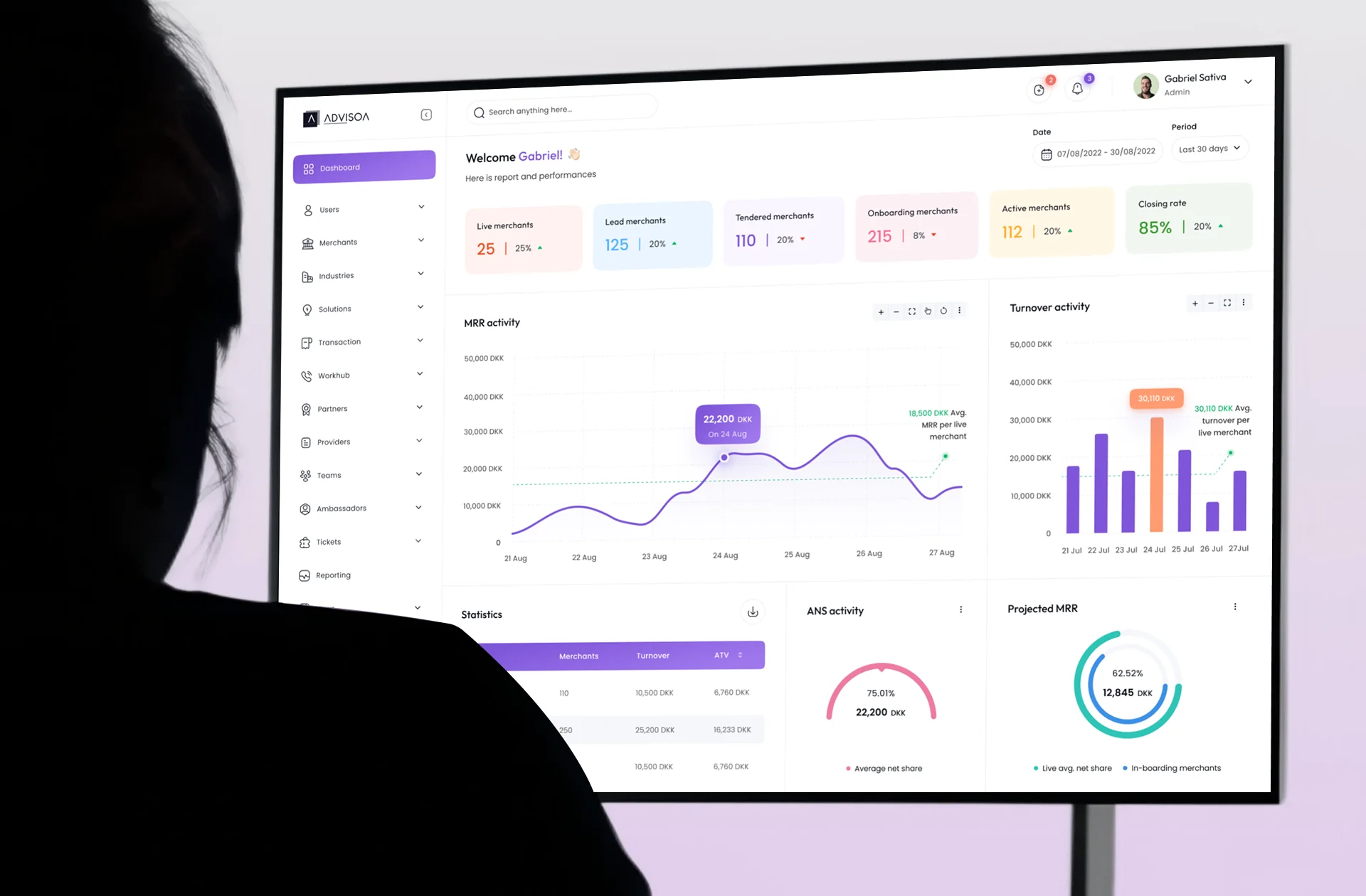

Empowering Webshops With Analytics

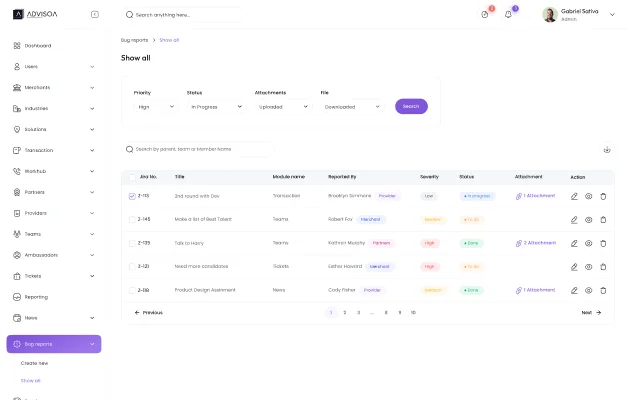

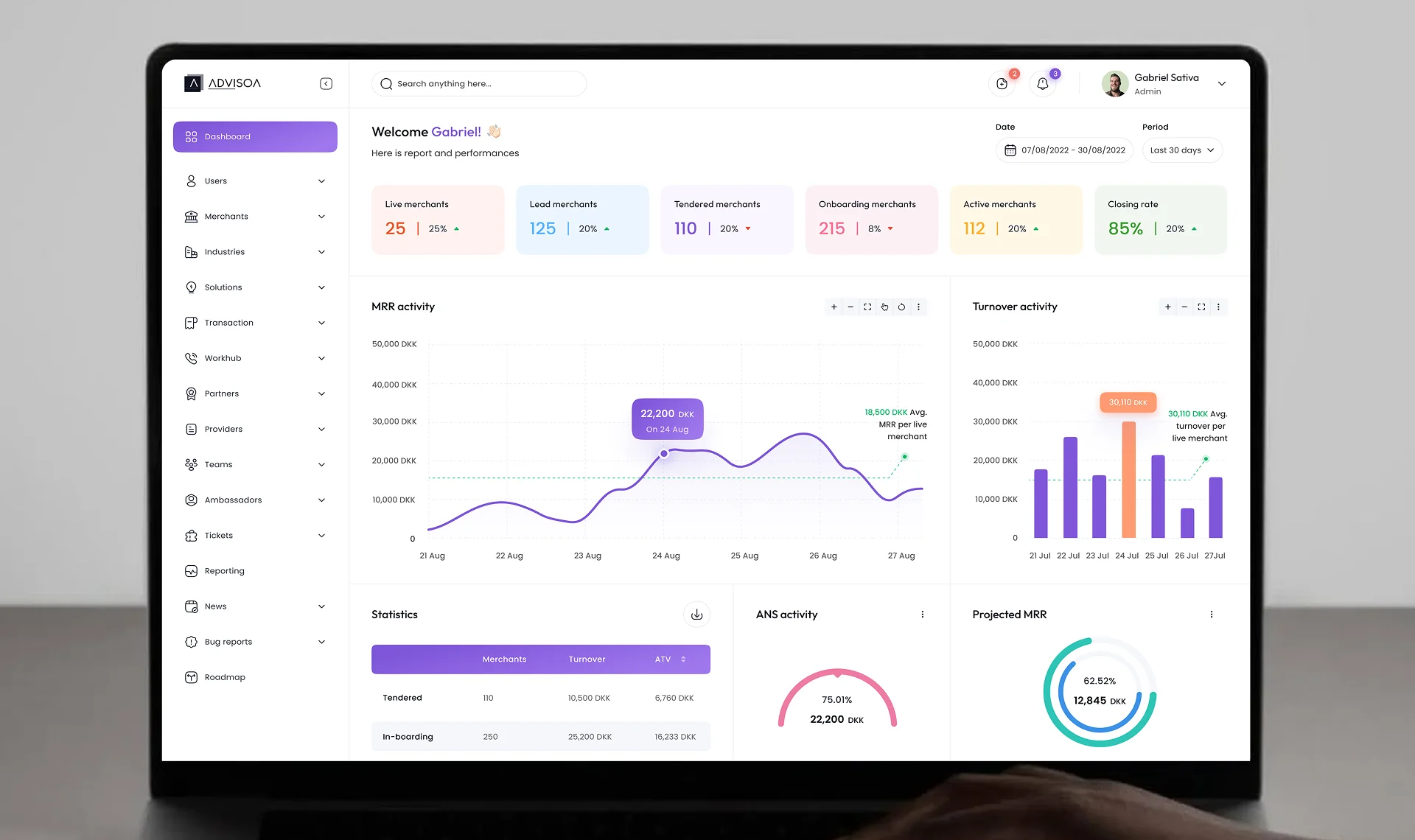

We empowered merchants with the insights they needed to take action before issues impacted their bottom line. To help webshops gain a clear picture of their payment landscape, we designed an intuitive customer-centric analytics dashboard that unifies data from payment providers, accounting systems, and webshop interactions.

The goal of this dashboard is to transform complex data—ranging from sales trends to payment performance and more—into clear, actionable metrics, enabling webshops to make informed, data-driven decisions.

The Team Behind The Project

Implemented encryption, access controls, and compliance. They used AES-256, HTTPS/TLS, and RBAC to maintain data integrity and trust across the platform.

Built the digital platform using Next.js and Node.js, featuring a high-performance and scalable backend capable of handling large volumes of transaction data. We developed secure APIs for seamless integrations with multiple payment providers, accounting systems, and webshop platforms.

Ensured system reliability, security, and accuracy. Through automated and manual testing, they rigorously validated transaction flows, reconciliation processes, and platform stability under various conditions.

Designed a clean, user-friendly interface. Through wireframing, prototyping, and user testing, they created a seamless experience that made payment management intuitive and efficient.

A Unified Payment Ecosystem For Workshops

The launch of the payment management platform marked a turning point for webshops, transforming the way they handle transactions, accounting, and financial optimization. Key impacts include:

Businesses achieved significant savings by securing better rates and optimized payment agreements, directly boosting their bottom line.

The platform’s autonomous accounting integration delivers real-time accuracy and ensures full compliance with Denmark’s Digital Accounting Act.

A unified dashboard brings together payment providers, accounting tools, and financial analytics, reducing blind spots and empowering merchants with actionable insight.

Redefining financial ecosystems with automation and compliance-driven intelligence—let’s build together.

Let’s Connect