Tips for Integrating Payment Gateway in a Mobile App

- Mobile

- October 4, 2017

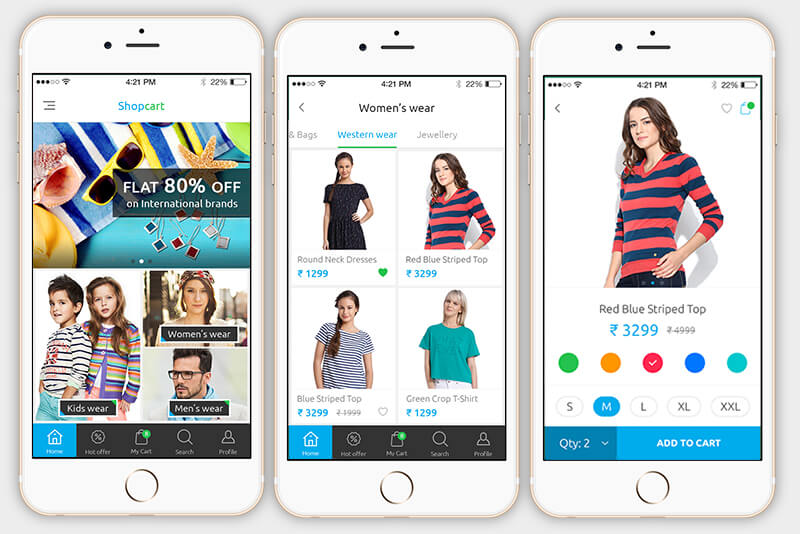

We are living in an era where online shopping and the e-commerce business solutions have become the order of the day. This has enabled the e-commerce apps to implement and integrate the payment gateway that can complete the online transaction with just a couple of clicks.

The users can make easy payments for availing a number of services such as purchasing an item from an e-commerce site, booking train or flight tickets, hotel reservation, booking a cab, paying bill for a good meal at a restaurant and so on.

And the reason why payment gateway has become the need of the hour can be understood from the current statistics. According to BI Intelligence report, the market associated with in-store mobile payments is estimated to reach at $503 billion by the year 2020.

One should also not underestimate the fact that payment gateways have been a great helping hand in booming the sales because now making payment is as easy as an apple pie.

How To Implement Payment Gateway in Mobile Apps?

The owner of the brick and mortar store will first require a merchant account as well as a payment gateway. The procedure in the case of the mobile application is more or less the same as both the accounts are needed.

Let’s Know the Mechanism in Short

The customer visits the e-commerce app and chooses the product he prefers to buy. The product is then added to the cart and then the cart gets linked up with the payment gateway.

Now once the request is sent to the card processor, the payment gets approved. Next the information is automatically displayed from payment gateway to merchant account. This information will remain stored for some days unless and until it is sent to the merchant’s bank.

Read also: Things To Consider Before Integrating Payment Gateway in a Mobile App

The Different Kinds of Merchant Accounts

As such there are basically two major types of merchant accounts that payment processors are offering. It includes:

- Dedicated Merchant Account

- Aggregated Merchant Account

The Dedicated Merchant Account

If you are an individual business owner or a merchant, then the dedicated merchant account is tailor-made for your business transactions. But in order to implement it, you will have to bear some additional expenditure and this will probe difficulties especially if your budget estimate is not higher.

Different set of providers will charge different fees. However, it enables the owner to control his funds and expenses; but it has some disadvantages as well. The purchase process takes longer time and it takes a deep insight on the credit check.

The Aggregate Merchant Account

The Aggregate Merchant Account is one place where you can store all your funds together including the other people’s money. It is more popular and evidently used than the dedicated account.

In fact, the big payment processing players like PayPal, Braintree and Stripe are all offering the aggregate merchant account. You are required to provide some of your personal info in this type of account.

Unlike the dedicated, it has a quicker acquisition and the process is also less complex than the earlier.

Direct Credit Card Integration or Using API’s

Well, there are a number of gateways allowing the users to make purchases through debit or credit cards using the app API for processing transaction.

You may think that it is a cakewalk but the real picture is quite different. You will have to encounter a number of difficulties while implementing it.

One of its main disadvantage is that you have to owe the entire responsibility of processing a safe and secured purchase with the digital transaction of the money while integrating the API.

This means you will be solely held responsible if in case there is any misappropriation of online funds or fake dealing.

And this is not all. There is more to come. You may have to face the problem of not being able to pay via certain gateways as it does not accept payments through mobile apps and also does not support the tokenization process. This is because it does not find an authenticated environment.

Implementing the Payment Card Industry or PCI’s

If you do not want to avail the risk of API, then you can choose a much safer option and that is none other than the Payment Card Industry or PCI. It does not trouble you much as in the earlier case.

In fact, because of the security factors, most of the payment processors like Stripe, Braintree etc. are opting for PCI. Their benefits include getting a comprehensive native solution and updated strong library for both Android and iOS Operating Systems.

Another advantage is using of full encrypted data on the card as give it as token. However, here you will have to bear an additional service charge of 2.9% + $.30 for all types of cards.

Some of the Major Payment Gateway Providers

PayPal

PayPal has gained prominence ever since it was introduced in the form of digital wallet. In fact, many people prefer to use PayPal for online shopping or booking tickets.

The use of PayPal SDK mobile allows you to accept Bitcoin, credit card payments etc. The features include:

- It offers the facility of split payment

- You can create a simple invoice

- You can get report of your financial activity

- You can pay to different people at one time without any inconvenience caused

- Host your own checkout page

- Used predominately in 203 nations and supports 26 various currencies

Stripe

Stripe undoubtedly has been voted as the number one payment processor amid all the other competitors. It has a simple design that offers a lot of scope for the developers to provide customization.

It also is implemented with a number of APIs and supports large volumes of libraries. Some of its advantages include:

- It comprehensively supports both iOS and Android platforms for the payment process.

- You can also integrate the social media buttons for payment process

- You can get to know about your monthly financial report

- Can make easy payments in more than hundred currencies and also accepts Bitcoin as well

- Can get customized payment forms to enhance your business

Braintree

Braintree is yet another payment processor that can process payments from popular apps such as PayPal, Apple Pay, Google Pay and credit cards.

Many of its features are similar to that of the Stripe. The features include:

- It also offers the facility of recurring bill

- The payments can be authorized with just one click via the use of PayPal and Venmo

- The payment through credit cards are safe and secure as it uses the Payment Card Industry or PCI. You can remain stress free while making payments.

- It is widely used in more than forty countries and supports 130 different currencies

So Who is the Winner?

Well, all are extremely tough competitors and they both are offering more or less the same advantages and features. All the processors claim of offering the best and hassle free payment process where the environment is entirely secured.

But in terms of popularity Stripe scores better than Braintree. However, overall both are efficient in instigating their services.

Integrating SDK in an App

This is one of the most vital aspect of the discussion. You are well familiar that each of the providers provide a developer SDK.

These are nothing but the robust library data facilitating the credit card information while processing. The task of the developers become simpler as it helps in the processing of the credit cards.

Another benefit is that it reduces the risks related to the PCI compliance. Most of the software tools are available on the official website of the payment gateway processor.

Furthermore, it also allows you to develop payment forms to be used for gathering of audience data.

Let us cite the instance of Stripe; a leading payment gateway processor. You will come across a couple of options here that includes a pre-developed form component or you can choose to create a form on your own.

The second option is more viable as you can take full advantage of UX and do not have to depend on the pre-built widgets. In the case of iOS phones and iPads, the Apple developers are still in action working tirelessly for offering an optimal and smooth experience as far as the payment gateway is concerned.

The iOS users will have the in-built facility wherein they can make payments with just a click of the mobile app using their credit card.

Now if talk about the Google Android, it follows more or less the similar technique. The Google Pay is found in its beta version and it helps in accessing the payment data available in the Google account of the customer.

As such the process of tokenization is only made available in mobile payment system. The provider tends to tokenize the confidential data of the user with the assistance of mobile library, which is then resend to the server.

This procedure can also be regarded as the authenticated environment. The exchange of the data from one server to the other takes place through API keys.

You will get the detailed information about integration of payment gateway including the instructions on the official websites of the developers.

Read also: eWallet Mobile App Development: Key Features and Cost Estimation

Conclusion

Well, whether you are the owner of an e-commerce business solution or having travel or tour business or rather associated with the hotel industry, it’s prevalent to have a payment gateway in your mobile app or the website.

You need to be careful while choosing the process of payment gateway and also the payment processor. Payment gateways have simplified the process of making online payments giving your business an edge over others.

Frequently Asked Questions (FAQs)

The payment gateway is a service that processes payments for various e-commerce within websites and mobile apps. It works for securely transferring the money from one account to another account.

To add the payment gateway, merchants need to have their accounts registered with the payment gateway to get the amount sent by the users. Most of the time, users are simply asked to add details such as a credit card, UPI, or ID and the amount to be transferred by the user.

While selecting the payment gateway for your projects there are several factors need to keep in mind such as the cost of implementation, Security, Data Portability, Internationally acceptable, Business model, Fees, and customer experience.

It solely depends on the project requirement and targeted countries. For the worldwide targeted audience, integrating International Payment Gateways would be the best option, whereas; for the local audience, popular local payment gateways should be integrated by you.

There are a large number of payment gateways available in the market but, the cost of integrating each payment gateway depends on the development model as well as the complexity of the Payment Gateway.